montgomery county maryland earned income tax credit

For example if the State refunds 100 the County will add an additional 100. If the taxpayer qualifies for the Refundable EIC from the State of Maryland then they will receive an additional payment from Montgomery County.

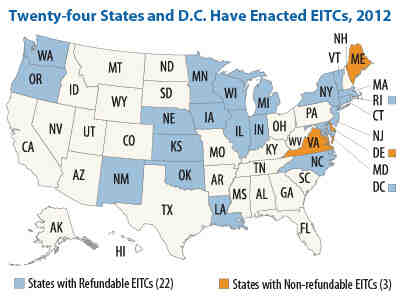

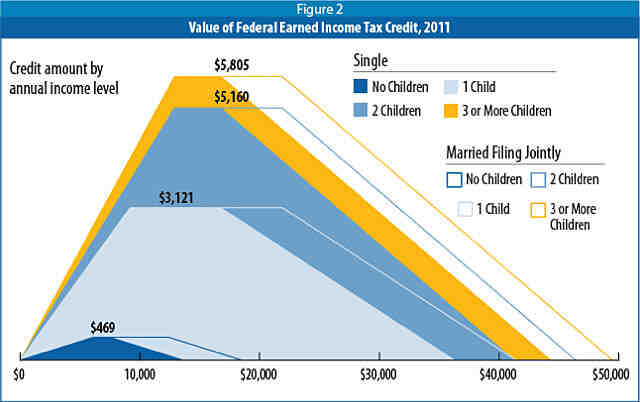

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year.

. The Earned Income Credit or EIC is a credit that is income based and is initiated by filing Maryland income taxes by April 15th of every year. In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state-level EITC. 47915 53865 married filing jointly with two qualifying children.

In recognition of Earned Income Tax Credit Awareness Day January 28 County Executive Marc Elrich encourages residents to Get All Your Tax Credits. Every county and municipality in Maryland is required to limit taxable assessment increases to 10 or. This is available for the 2021 tax year dependent on your adjusted gross income AGI.

The federal credit is currently worth up to 6600 and can either reduce the amount of income tax owed or increase the income tax refund amount. If you either established or abandoned Maryland residency during the calendar year you are considered a part-year resident. For Immediate Release.

The earned income tax credit EITC is one of the most successful social policies of the last two decades said Duncan. The EITC makes work pay. See instruction 26 in the Maryland Tax Booklet for more information on claiming the Earned Income Credit.

Department of Finance Treasury Office Ms. Earned Income Tax Credit EITC is a unique tax credit that puts money back into the pockets of low-and moderate-income workers. Friday January 28 2022.

Earned Income Tax Credit EITC. The refund is separate from the Maryland state tax refund and will arrive separately. The maximum federal credit is 6728.

There is a regular State EIC and a Refundable EIC component. If your earned income income from a job falls below certain levels you may qualify for a reduction in taxes and possibly a refund. The Maryland earned income tax credit EITC will either reduce or.

Federal and State Credit Participation Rates The Internal Revenue Service recently estimated that about 24 of eligible taxpayers in Maryland did not claim the federal earned income tax credit compared to 22 of eligible taxpayers that did not claim. Previous law required that in order to claim the WFIS tax credit a resident must be eligible and qualify for both the federal and state earned income tax credit. Earned Income Tax Credit ARPA.

Federal Maryland and Montgomery County tax programs offer earned income credits EIC. March 9 2021. Eligibility and credit amount depends on your income family size and other factors.

The General Income Tax Credit The one-time 1000 tax credit for each qualified new employee filing a newly created position in an enterprise zone or one-time 1500 credit for each qualified new employee in an enterprise zone focus area. Montgomery County will match a taxpayers State Refundable EIC dollar for dollar. There are two types of income tax credits for businesses in an Enterprise Zone.

If the State has been contacted and is referring back to the County andor if this is a County issue please contact. It is important to note that montgomery county is the only c ounty in maryland that offers a local income tax credit for its residents with a 100 match of the state earned income credit for the applicable tax year. See Marylands EITC information page.

As opposed to less well-targeted approaches the EITC benefits the vast majority of working families with children that are poor or near poor Other highlights of the County Executives Rewarding Work package include a more than 50 percent. The Honorable Vanessa E. Questions regarding eligibility for either the State or Montgomery County EIC must be addressed to the State of Maryland Office of the Comptroller at.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Montgomery County Working Families Income Supplement. You may be eligible to claim an earned income tax credit on your 2021 federal and state tax returns if both your federal adjusted gross income and your earned income are less than 51464 57414 married filing jointly with three or more qualifying children.

See the Montgomery County website for more details. 28 of federal EITC. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

And Members of the House Ways and Means Committee FROM. If you are neither a Full-Year Resident nor a Part-Year Resident you are not a resident. R allowed the bill to take effect without his signature.

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability. The Maryland earned income tax credit. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

50 of federal EITC 1. It is important to note that Montgomery County is the only county in Maryland that offers a local income tax credit for its residents with a 100 percent match of the state earned income tax credit for the applicable. Residents with household incomes of 58000 or less may be eligible for the federal State and County Earned Income Tax Credits EITC and free tax.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Income limits vary depending on your filing status AGI and the number of. Montgomery County Working Families Income Supplement is based on the State refundable credit claimed by a county resident.

Business deductions lower taxable income which results in a lower tax bill for 2021. EITC Information in Spanish. Montgomery County Working Families Income Supplement.

Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. The Honorable Alonzo T. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

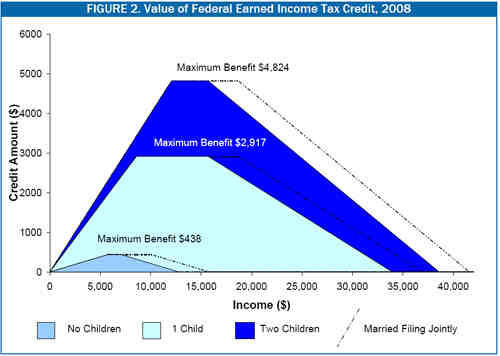

Federal Earned Income Tax Credit. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. Calculate your federal EITC.

If you earn less than 57000 per year you can get free help preparing your maryland income tax return through the cash campaign. Earned Income Tax Credit EITC Rates. The Homestead Credit limits the increase in taxable assessments each year to a fixed percentage.

To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit. 10 BY repealing and reenacting with amendments 11 Article Tax General 12 Section 10704 13 Annotated Code of Maryland 14 2016 Replacement Volume and 2018 Supplement 15 SECTION 1. Montgomery County Community Action Board Testimony in Support of SB369 Income Tax Maryland Earned Income Tax Credit Assistance Program for Low-Income Families March 23 2022.

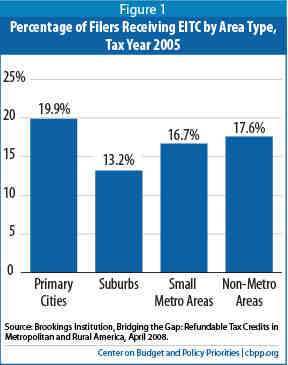

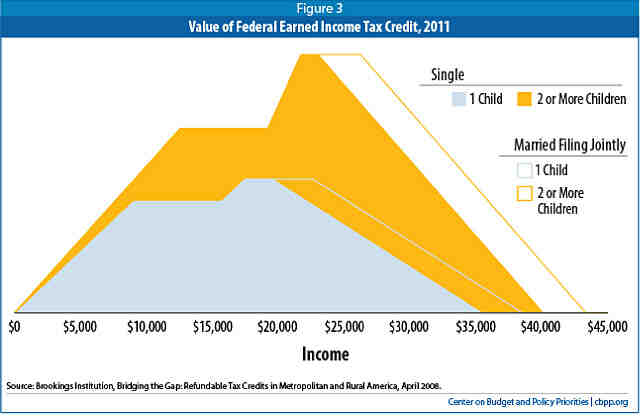

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

Montgomery County Md 311 Answering To You

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

When Will I Receive The Money Earned Income Tax Credit

Earned Income Tax Credit Wikiwand

Child Tax Credit Health And Human Services Montgomery County

Montgomery County Md 311 Answering To You

February 2022 Community Action Agency E Newsletter

Earned Income Tax Credit Wikiwand

Montgomery County Md 311 Answering To You

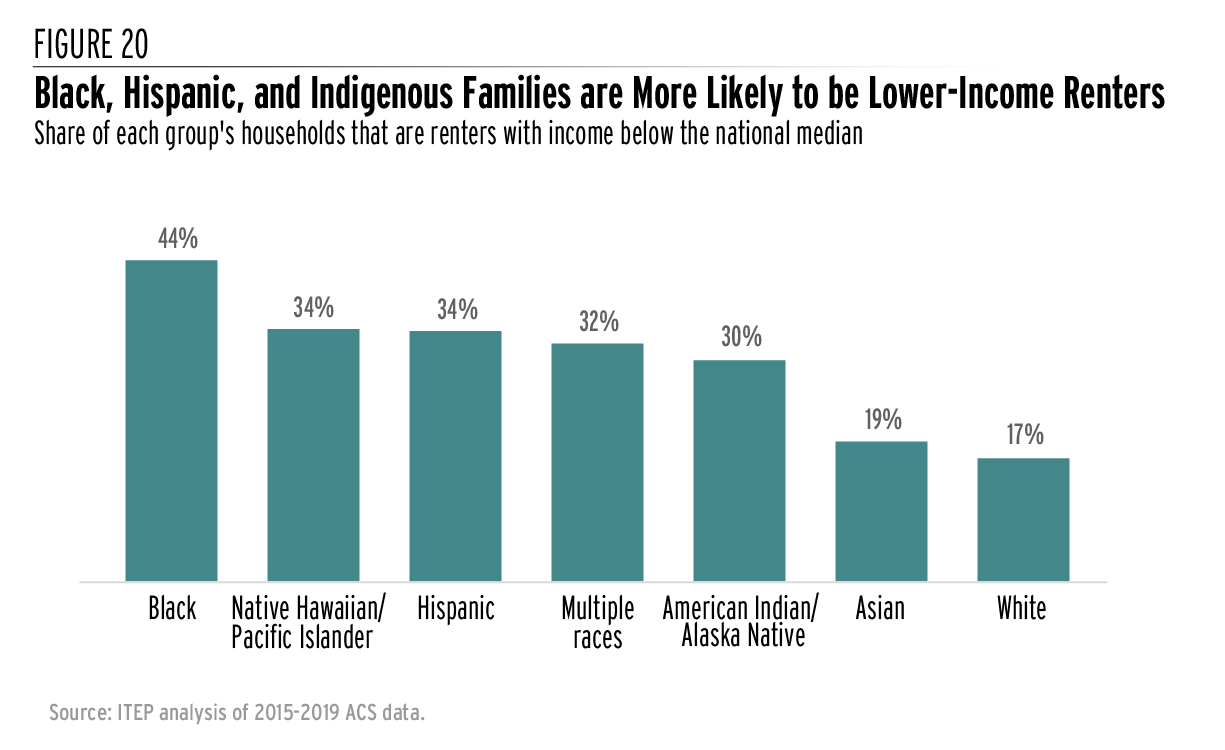

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

3 Things You Probably Don T Know About The Earned Income Tax Credit

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

Earned Income Tax Credit Wikiwand

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities